Annual Reporting Guidelines for the Institutes and Centers

Background

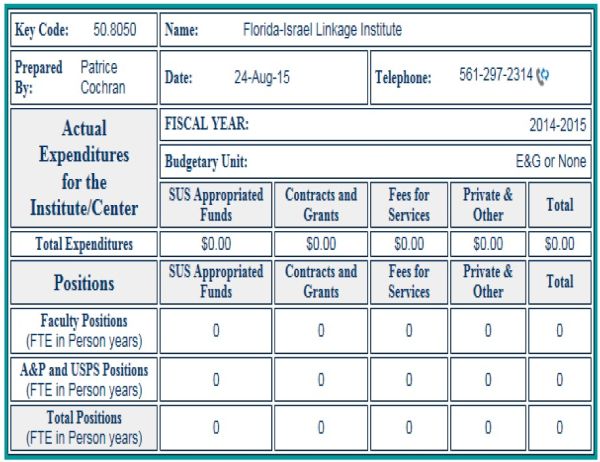

Annually, by September 30th, the University is required to submit all actual and projected expenditures as well as actual and estimated FTE for its Institutes and Centers (I/C) to the Board of Governors. In order to submit this information by the stated deadline, we require that all information be entered online by each I/C by no later than the 12th of September. Below is an illustration of the online form to be completed

The form is divided in different budget categories as follows:

- SUS Appropriated Funds (Educational and General) all state appropriated funds.

- Contracts and Grants: expenditures incurred on grant or overhead accounts.

- Fees for Services: funds collected in return for services by the I/C. This includes deposits made in the FAU Foundation, Aux., or other accounts for conferences, seminars, lectures, license fees, royalty income, proceeds from the sale of publications, etc.

- Private & Other: funds from gifts or donations, or money obtained from sources not listed above.

Preparing the Reports

Expenditures

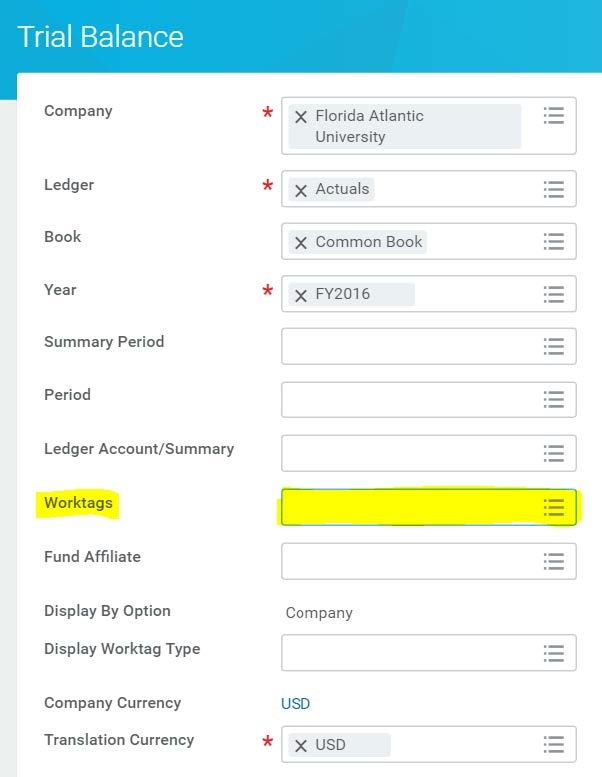

The actual expenditure and FTE data should be prepared based on the fiscal year-end data. For the expenditure data, we recommend using the final year-end Trial Balance, available in Workday. This report shows the transaction activity by the SmartTag entered in the Worktags section. The data on this report provides both the Labor (ledger accounts 6XXXX) and non-labor (ledger accounts 7XXXX) expenditures.

The estimated expenditures should be based on the best knowledge available at the time the report is prepared. Estimates could be based on the last prior actual expenditures, next year’s estimated revenues, prior estimated unspent funds, as well as additional information available when preparing the reports. The basis and logic of methodologies used to estimate the expenditures should be clearly documented. All supporting documentation should be kept for future reference and audits.

FTE

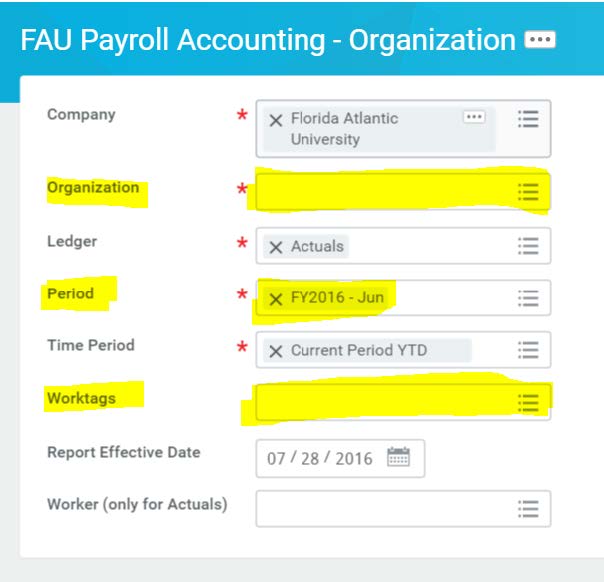

The actual FTE data should be based on the expended salaries reported. Do not use the FTE reported on the “All Jobs” worker tab in Workday, since this does not identify the actual FTE spent. Rather, the actual salary expenditure should first be determined. To get annual salary information, use the Payroll Accounting - Organization report available in Workday.

Select the:

Organization: Enter the Cost Center (CCXXXX).

Ledger: This should be automatically populated. Verify that the selection is ‘Actuals’.

Period: Select the report Fiscal Year (FY2016 – Jun)

Time Period: This should be automatically populated. Verify that the time period is ‘Current Period YTD’.

Worktags: Enter the Worktags. If you leave the Worktags section blank, the report will pull all SmartTags associated with the Cost center entered in the Organization section. Once created, the report can be filtered by the Worktag (SmartTag).

Upon display of the results, the report can be filtered further by worker and amounts totaled.

The projected FTE should commensurate the related salary and benefit expenditures. For example, if the total salaries and benefits equal $90,000 per employee, and the projected salaries and benefits indicated on the report equal $180,000, then the related projected FTE should equal 2.0

Expenditures to be Reported

- Report the total I/C actual and projected expenditures.

- Only report those expenditures that come directly from the I/C budget.

- Do not double count expenditures.

- If there are multiple subunits, include the expenditures for all subunits.

- Salaries and Benefits:

- Report the salaries plus all related benefits.

- Report only what is entirely or partially paid for by the I/C funds.

- Report in terms of full-time equivalent (FTE) in person years of the annual salary plus benefits.

- If the position is paid from split sources, the expenditures should be reported accordingly.

- Only report compensation for people directly paid by the I/C.

- Salaries and Benefits:

Example 1: An AMP or USPS (SP) (12-month) position assigned for 12 months to the I/C (or 1.0 FTE) during which time the individual’s salary and benefits are paid from the I/C’s budget, the entire position’s salary plus employee benefits should be reported under the appropriate fund source column.

Example: An AMP or USPS (SP) (12-month) position assigned for 3 months to the I/C (or .25 FTE) during which time the individual’s salary and benefits are paid from the I/C’s budget, one-quarter of the position’s salary plus employee benefits should be reported under the appropriate fund source column.

Example 3: For a 9-month faculty position which is assigned for 4 ½ months to the I/C (or .5 FTE) during which time the individual’s salary and benefits are paid from the I/C’s budget, one-half of the position’s salary plus employee benefits should be reported under the appropriate fund source column.

Example 4: For a 12-month faculty position which is assigned for 9 months to the I/C (or .75 FTE) during which time the individual’s salary and benefits are paid from the I/C’s budget, three-quarters of the position’s salary plus employee benefits should be reported under the appropriate fund source column.

Example 5: An A&P or USPS (SP) (12-month) position which is assigned for 12 months to the I/C, or 100 percent of the total position’s time is assigned to the I/C during which time the individual’s salary and benefits are paid from the I/C’s budget, but the entire position was vacant for three of the 12 months, three-quarters of the position’s total salary plus employee benefits should be reported under the appropriate fund source column (which represents only the salary and benefits the I/C actually paid).

Example 6: If the Faculty, A&P, or USPS (SP) (12-month) position is assigned for 12 months to the I/C and fifty percent of the individual’s salary and benefits are being paid from Educational and General (state appropriated) funds and fifty percent is being paid from Contracts and Grants, the appropriate portion of the salaries and benefits should be reported under each fund source column accordingly.

- Other Personal Services (OPS):

- Temporary employees, students, graduate assistants, etc.

- Only report compensation for people directly paid by the I/C.

- Expenses: travel, supplies, other consumables, rent, utilities, etc. If paid for by the I/C.

- Other Capital Outlay: equipment, fixtures, and other tangible personal property of a non-consumable and nonexpendable property with a cost of $5,000 or more.

Position Data (FTE)

- Report all line positions that are funded by an I/C budget.

- Vacant positions that are assigned to the I/C should also be reported even if there are no expenditures reported.

FTE Calculation:

- Report the data in terms of full time equivalent (FTE) in person years.

- A person year for a twelve month position is equivalent to 1.0 FTE if the position is a full-time position budgeted for 12 months.

- If the position is a 9-month faculty position, 1.0 FTE in person years is 9 months.

Example 1: If reporting an A&P or USPS (SP) (12-month) position which is assigned for 12 months to the I/C, or 100 percent of the total position’s time is assigned to the I/C and paid from the i/C’s budget, then it would be reported as 1.0 FTE under the appropriate fund source column.

Example 2: If reporting an A&P or USPS (SP) (12-month) position which is assigned for 3 months to the I/C, or 25 percent of the total position’s time is assigned to the I/C and paid from the I/C’s budget, then it would be reported as .25 FTE under the appropriate fund source column.

Example 3: If reporting a 9 month faculty position which is assigned half-time (or an equivalent to 4 ½ months) to the I/C and paid from the I/C’s budget, then it would be reported as .50 FTE under the appropriate fund source column.

Example 4: If reporting a 12-month faculty position which is assigned 9 months to the I/C, or 75 percent of the total position’s time is assigned to the I/C and paid from the I/C’s budget, then it would be reported as .75 FTE under the appropriate fund source column.

Example 5: If an A&P or USPS (SP) (12-month) position, which is assigned for 12 months to the I/C, and 100 percent of the total position’s time is assigned to the I/C and paid from the I/C’s budget, but the position was vacant for three of the 12 months, it should still be reported as 1.0 FTE under the appropriate fund source column.

Example 6: If any position which is paid from the I/C’s budget is paid from two different fund sources within the I/C’s budget, the FTE should be split and reported accordingly under the appropriate fund sources for each portion of the FTE. For instance, a faculty, A&P or USPS (SP) (12-month) position which is assigned for 12 months to the I/C and 50 percent is paid from educational and general funds in the I/C’s budget and 50 percent is paid from contract and grant funds in the I/C’s budget, it should be reported as .50 FTE under educational and general and .50 FTE under contracts and grants.

Do not include the following:

- FTE for any OPS position.

- FTE for faculty and staff who are on loan to an I/C and who are not paid from the I/C’s budget.

- FTE for faculty or staff that work on the I/C’s project but are not paid for with the I/C funds.

- FTE for faculty and staff that are assigned to the I/C but are paid our of department funds and not I/C funds.

Estimated Data

- Report estimated data (expenditures and position data) based on the “best knowledge” available at that time.

- Best knowledge includes actual data that is available at the time your report is prepared.

- This includes the next year’s budget plus any expected changes to the budget.

Updated 07/25/2016