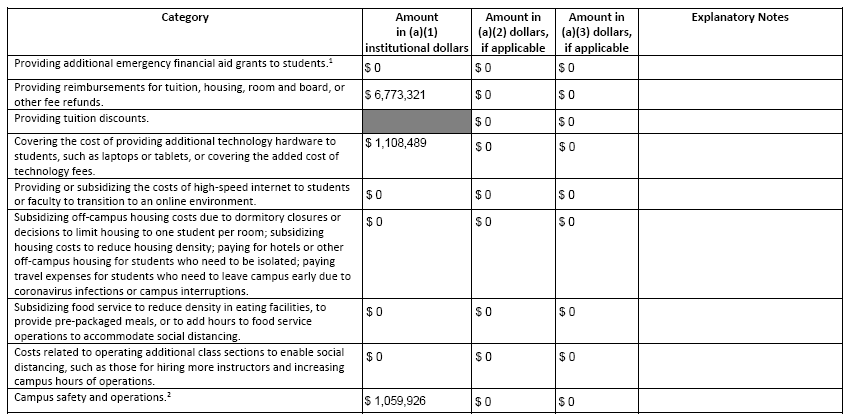

Quarterly Budget and Expenditure Reporting

under CARES Act Sections 18004(a)(1) Institutional Portion, 18004(a)(2), and 18004(a)(3), if applicable

OMB Control Number 1840‐0849 Expires 4/30/2021

Institution Name: Florida Atlantic University

Date of Report: 09/30/2020

Quarter Ending: 09/30/2020

Total Amount of Funds Awarded

Section (a)(1): Institutional Portion $11,214,937

Section (a)(2): $1,660,047

Section (a)(3): $0

Final Report: No

- 1. To support any element of the cost of attendance (as defined under Section 472 of the Higher Education Act of 1965, as amended (HEA)) per Section 18004(c) of the CARES Act and the Interim Final Rule published in the Federal Register on June 17, 2020 (85 FR 36494). Community Colleges in California, all public institutions in Washington State, and all institutions in Massachusetts have different requirements due to recent U.S. District Court actions. Please discuss with legal counsel. HEERF litigation updates can be found here.

- 2. Including costs or expenses related to the disinfecting and cleaning of dorms and other campus facilities, purchases of personal protective equipment (PPE), purchases of cleaning supplies, adding personnel to increase the frequency of cleaning, the reconfiguration of facilities to promote social distancing, etc.

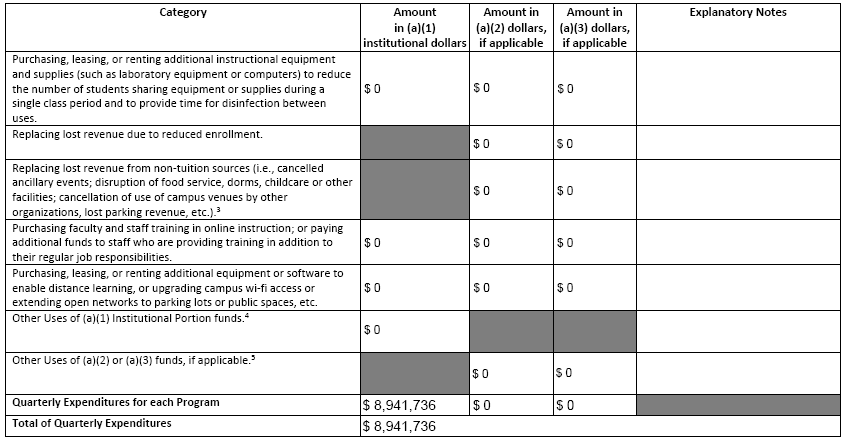

3. Including continuance of pay (salary and benefits) to workers who would otherwise support the work or activities of ancillary enterprises (e.g., bookstore workers, foodservice workers, venue staff, etc.).

- 4. Please post additional documentation as appropriate and briefly explain in the “Explanatory Notes” section. Please note that costs for Section 18004(a)(1) Institutional Portion funds may only be used “to cover any costs associated with significant changes to the delivery of instruction due to the coronavirus, so long as such costs do not include payment to contractors for the provision of pre-enrollment recruitment activities; endowments; or capital outlays associated with facilities related to athletics, sectarian instruction, or religious worship.”

- 5. Please post additional documentation as appropriate and briefly explain in the “Explanatory Notes” section. Please note that costs for Sections 18004(a)(2) and (a)(3) funds may only be used “to defray expenses, including lost revenue, reimbursement for expenses already incurred, technology costs associated with a transition to distance education, faculty and staff trainings, payroll incurred by institutions of higher education and for grants to students for any component of the student’s cost of attendance (as defined under section 472 of the HEA), including food, housing, course materials, technology, health care, and child care.”